massachusetts real estate tax rates

An owners property tax is based on the assessment which is the full and fair cash value of the. Edgartown has a property tax rate of.

Moved South But Still Taxed Up North

Website 6 days ago Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the.

. Tax rates in Massachusetts are determined by cities and towns. If youre responsible for the estate of someone who died you may need to file an estate tax return. Tax amount varies by county.

Below are 10 Massachusetts towns with the lowest property tax rates. Tax amount varies by county. This report includes all local options except meals rooms short-term rentals and recreational.

Property tax is an assessment on the ownership of real and personal property. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. They are expressed in dollars per 1000 of assessed value often referred to as mill.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

Under Massachusetts law the government of your city public schools and thousands of other special purpose districts are given authority to evaluate real estate market value set tax rates. 370 rows Massachusetts Property Tax Rates by Town. Real estate taxes in Massachusetts are the seventh highest in the entire US.

Local Options Adopted by Cities and Towns. Today the Massachusetts real property tax rate depends on the city or town as well as classification. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

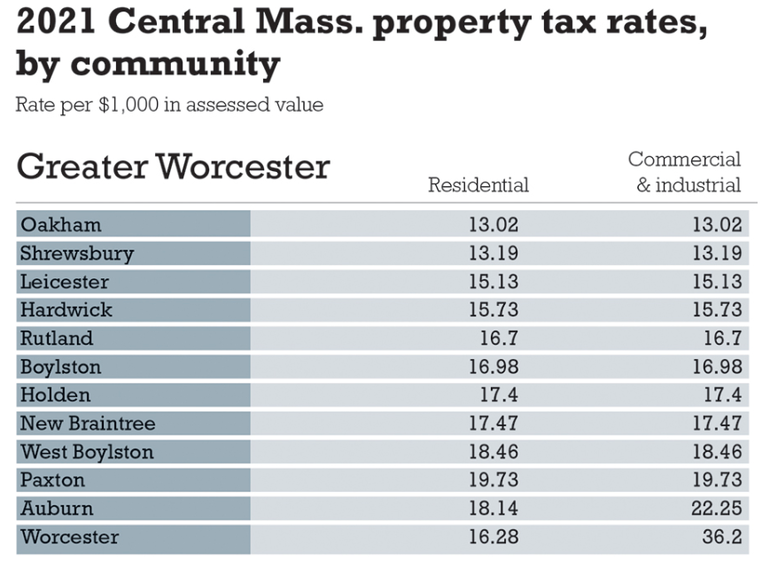

If you are age 65 or older you may be eligible to claim a refundable credit on your personal state income tax return. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915. Click here for a map with additional tax rate information.

Massachusetts Property Tax Rates 2022 Town by Town. Hancock has a property tax rate of 300. In December 2022 it is expected that the City Council will vote on this years new tax rate based.

The states average effective tax rate is slightly above the national average at 121. Counties in Massachusetts collect an average. This was based on property values associated with real estate market trends in 2020.

Chilmark has a property tax rate of 282. Massachusetts Property Tax Rates. 351 rows 2022 Massachusetts Property Tax Rates.

The Senior Circuit Breaker tax credit is based on the actual. Counties in Massachusetts collect an average. Adopted Local Options Impacting Property Tax.

Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate. But the total tax levy for the city or town remains the same. The three Worcester County towns with.

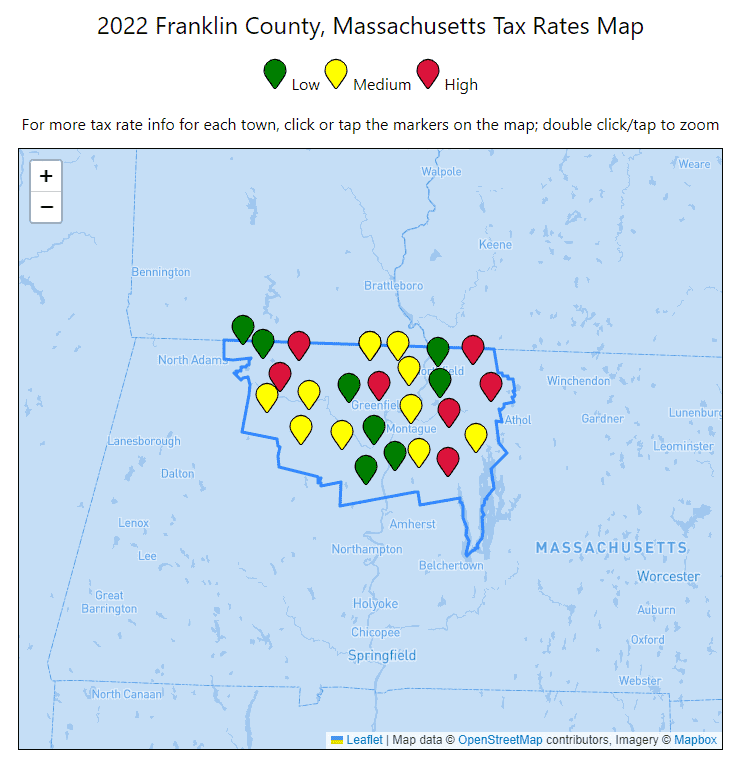

2022 Franklin County Massachusetts Property Tax Rates Includes Greenfield Montague Orange Deerfield Etc

What Is The U S Estate Tax Rate Asena Advisors

These States Have The Highest Property Tax Rates Thestreet

Property Tax Information City Of Cambridge Ma

Massachusetts Property Tax Rates In 2018 By Town And City Boston Business Journal

U S Cities With The Highest Property Taxes

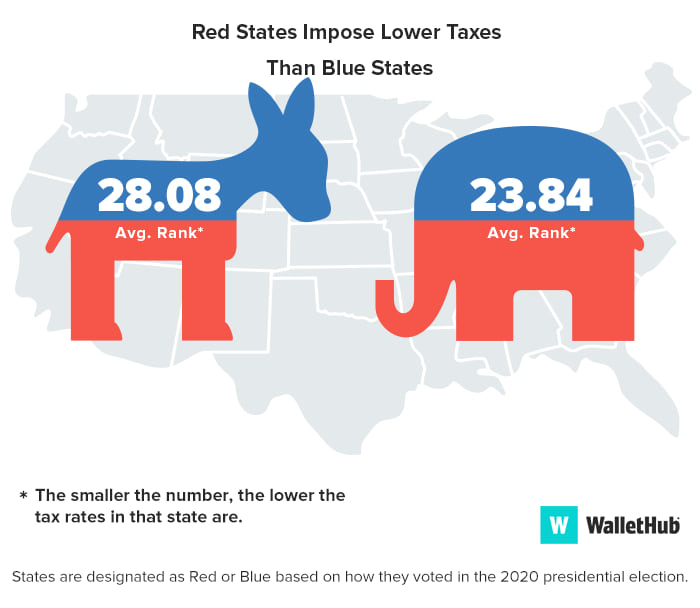

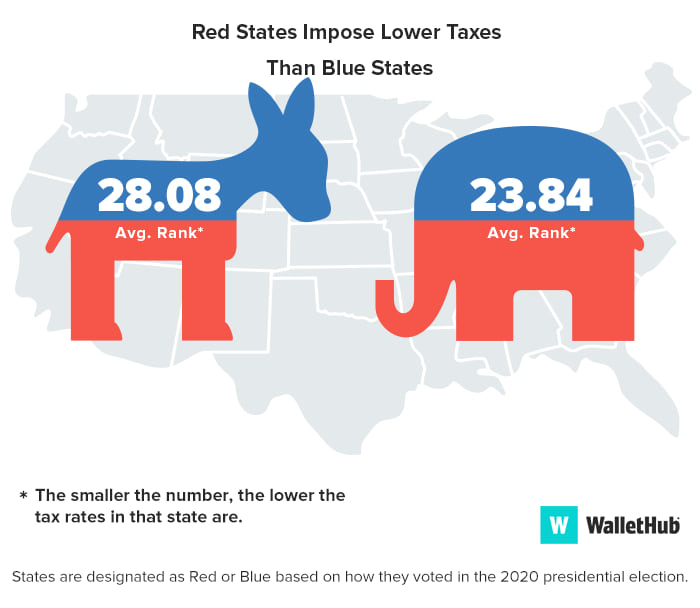

States With The Highest Lowest Tax Rates

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

2019 Massachusetts Tax Rates For Real Estate Residential Property

How Do State And Local Property Taxes Work Tax Policy Center

Massachusetts Property Taxes By County 2022

The No 1 Most Expensive State To Buy A Home In It S Not New York Or California Marketwatch

Boston S Tax Rates Set For Fy21 Boston Municipal Research Bureau

Newton City Council Approves Higher Property Taxes Newton Ma Patch

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Report Massachusetts Ranks Among Worst States For Property Tax Competitiveness Worcester Business Journal

Massachusetts Property Taxes With Property Tax Rates From Most To Least

Massachusetts Property Tax Rates Christine Mclellan William Raveis Real Estate